Factoring, together with Confirming, is a financing product for companies that is becoming increasingly important in Spain. According to data published by the Spanish Factoring Association in August, Factoring and Confirming activity in Spain grew by 8.2% during the first half of 2023, compared to the same period last year. We must also remember that in 2022 these products involved more than 90% of the closing balance of commercial financing in Spain, exceeding the $250 billion threshold in disposals (almost one out of every five euros of Spanish GDP was disposed of and managed through this type of operation).

It is not only in Spain where factoring activity has clearly increased: according to data from Factors Chain International, in 2022the global volume of Factoring international growth of more than 18%. compared to 2021 (with Europe accounting for more than 68% of turnover, where the business is mainly concentrated).

But what is the origin of this business that is so important today? As Antonio Calvo and María Isabel Bonilla point out in their article “Factoring in Europe and the United States”[i], there is no unanimity of criteria when it comes to determining how and where factoring began. Some historical studies place its appearance in the Babylonian culture, 5,000 years ago.[ii]. It seems that the Mesopotamians were the first to develop a business register to ensure payment for services rendered within a certain period of time. We also know that similar activities existed in the Phoenician establishments in the Mediterranean and in the peddlers who in ancient Rome traded manufactured goods between the different regions of the Empire.

However, all authors agree in establishing the end of the 14th century and the beginning of the 15th century as the date from which Factoring experienced an important development. As Modesto Bescós points out[iii]In order for factoring to develop, it was first necessary for credit to appear. Therefore, it is with the bill of exchange (14th century) and the use of endorsement and discounting that the pillars of financing emerge.

According to Calvo y Bonilla, one of the turning points for the development of Factoring was the colonization of the lands discovered overseas by the European kingdoms. As trade with the colonies began to grow, local producers opted to hire agents to take care of local commercial interests in one or more overseas businesses. This would give rise to the so-called

Classic or Colonial Factoring,

which developed especially in the relations between London and the East Coast of the United States. Among the functions of the agents was the maintenance of the merchandise stored in warehousing and the sale of the merchandise on behalf of the manufacturer. Over time, many specialized in the textile sector and took on more and more responsibilities, such as guaranteeing the collection of the sales made and even advancing the amount of the sales to the manufacturers. It was in 1823 when the first law regulating the activity was published: the Factor’s Act.

But it was not until the beginning of the 20th century when factoring companies stopped performing, almost completely, commercial activities, specializing in financial activities (and specifically in the collection of receivables). It was then that Colonial Factoring handed over the baton to Old Line Factoring.

Old Line Factoring.

Later, in the United States, the development of Factoring was influenced by the complicated situation suffered by commercial banks in 1931 and 1933, due to the monetary crisis and the banking crisis, respectively. This situation was taken advantage of by factoring companies, which, not being subject to the regulations imposed on the banking sector, enjoyed much more flexibility both in granting loans and in determining interest rates. This was the birth of

New Style Factoring

was born, characterized by offering a more varied and specialized set of financial services.

In Europe the scenario was quite different: as Calvo and Bonilla point out, at the beginning of the 20th century “the practice of Factoring was in disuse, and it was not until the sixties when the American banking sector, seeking to satisfy the demand of national exporters, decided to “reintroduce” Factoring on the European continent. The first initiative to develop these operations in Europe was born by virtue of a collaboration agreement established between American and English banking companies, which founded the holding IFAG (International Factor’s AG) with the aim of promoting the creation of purely European companies, whose subsequent development has been largely due to the adaptation of American Factoring techniques to the sale of a much wider range of products and the offering of greater flexibility in the services provided.”

In order to link European companies to American entities, three different types of international factoring chains were set up:

-On the one hand, multinational branching systems were created through their own subsidiaries in different countries.

-On the other hand, closed chains were formed in which different factoring entities join together, and there may be only one member per country.

-Finally, open chains have been set up, allowing several members of factoring entities in the same country to work under common rules of conduct. This system was chosen by Factors Chain International, the largest international factoring chain in the world.

As for the case of Spain, and although it is evident that it played a fundamental role in the colonization of America, according to experts there are no figures similar to Factoring in the commercial relations established with the colonies. In fact, Calvo and Bonilla indicate that “it was not until the 1970s that the first factoring entities were established in our country.”

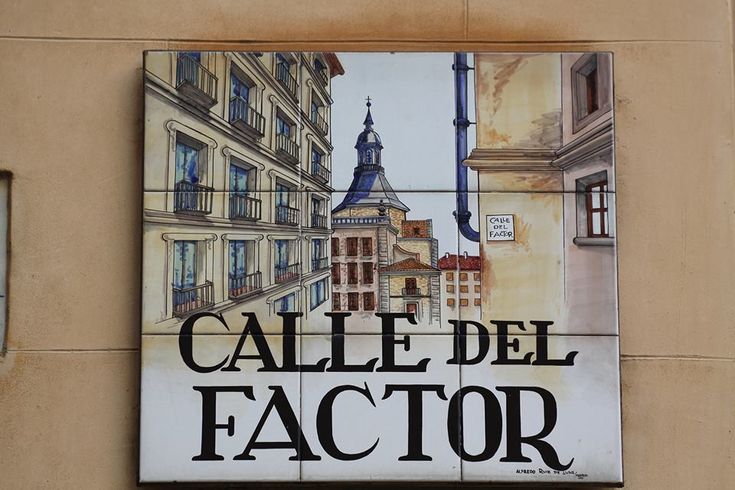

However, in our History, the figure of the Factor is contemplated, which in this case, was the individual who worked for the Crown, managing its tax accounts, goods and rents. In fact, in the center of Madrid is located Factor Street, which was so called because in the sixteenth century, lived there Fernán López de Ocampo, Factor of Philip II.

[i] Published in ICE Economic Bulletin No. 2738 (September 2002).

[ii] ALINGER, F.: Factoring Law and Practice. Sweet and Maxwell, second edition, London, 1995, page 4.

[iii] Bescós Torres, Modesto. Factoring and Franchising p. 15 Madrid 1990