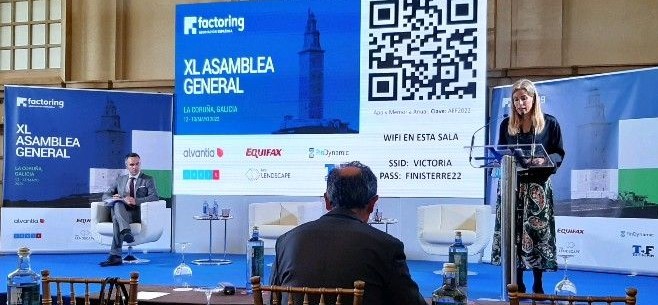

On May 12 and 13, the Spanish Factoring Association held its XL General Assembly at the NH Finisterre Hotel in La Coruña. The event was sponsored by Alvantia, which has not hesitated to once again support this important meeting of the trade finance sector in our country.

Alma María Abad, president of the AEF, and Fernando Guldrís Iglesias, general director at IGAPE (Galician Institute for Economic Promotion), opened the event, highlighting the unstoppable growth of the sector, which in 2021 increased its activity by 9%, with a total transfers of 199,364 million euros, exceeding 23% of GDP. Abad pointed out the importance that the services and benefits offered by Factoring and Confirming currently have in a situation in which small and medium-sized companies are improving their debt capacity, obtaining liquidity and insuring accounts receivable from a possible default. According to the Bank of Spain, Factoring and Confirming account for 89% of the working capital financing declared in Spain.

For his part, Guldrís highlighted the good progress of Galician exports and indicated that digitization and innovation are determining growth levers in the current economic context.

Afterwards, Pedro Veiga, Director of Strategic Planning at Abanca, shared with the attendees the latest data on the current situation of the Spanish economy and the prospects for its evolution. In this sense, he indicated that although inflation is skyrocketing, the accumulated savings of families are absorbing part of its impact. He also commented on data on tourist activity, a key factor in our economy, highlighting that although it was expected to reach 75% of the 2019 figures, already in the first quarter of 2022 it has reached 81% and the expectation now is to reach 85 -90%. Veiga also pointed out how the GDP and the CPI are expected to evolve, indicating that the most pessimistic estimates predict growth of 2.6% and 7.8% respectively and the most optimistic of 4.4% and 6.1%. respectively.

On the second day of the event, Enrique Albarracín, Head of Financial Regulation at EY Spain, made an interesting presentation on the current regulation of new technologies in the European financial sector. Albarracín pointed out that cloud computing is the most consolidated example in the financial sector of infrastructure outsourcing by financial institutions to technology providers and that its inherent risks are one of the greatest concerns of the European Banking Authority and the European Central Bank. The expert also indicated that the regulatory framework in digital finance at the cross-border level will improve the banking union and the union of the capital markets, in addition to strengthening Europe’s capacity to retain and reinforce the strategic autonomy of the financial industry.

The last presentation was given by Carlos Caballer, partner of PWC, who addressed a fundamental issue in his presentation: sustainability in the financial sector, which is very necessary to meet the objectives of the 2030 Agenda, set by the United Nations. Caballer pointed out that in 2018 there was a change in trend regarding sustainable finance, reinforced in 2020 with the start of the pandemic, and that a lot of legislation is currently being generated on the matter, with regulators and supervisors becoming more and more involved in it: “regulation is turning banking into the instrument for channeling capital flows towards a more sustainable economy,” he commented. He indicated that the number of standards for reporting non-accounting information continues to grow and that it is the fundamental responsibility of entities to enforce ESG criteria, which are no longer aspirational to become mandatory. For Alvantia, a member of the United Nations Global Compact Spain since 2014, sustainability is a key issue.